Veeda, through its V-Konnect series, interacted with Dr. Arun Bhatt and discussed “Clinical Trials in India and its regulatory perspective with New CT rules.”

About the V- Konnect

V-Konnect interview series is a program to get in touch with specialized industry experts to know their views on opinions on current relevant subject matters.

About Dr. Arun Bhatt – Consultant – Clinical Research & Development

Dr. Bhatt is currently working as a consultant in pharmaceutical medicine and clinical pharmacology.

He is the Editor-in-Chief of the ISCR journal- Perspectives in Clinical Research. Dr. Bhatt has extensive experience in the Indian pharmaceutical industry in clinical research, drug development, and regulatory affairs.

He was the former President of ISCR, President at Clininvent, CEO of CMI (India experience), and Medical Director at Novartis.

He was awarded the ISCR Special Award in 2017 for his contribution to the Research Fraternity, the Outstanding Service award by the Drug Information Association in 2012, and the Honorary Fellowship by Clinical Research UK in 2009.

He is also a qualified assessor of NABH Accreditation for Clinical Trials sites and has more than 150 publications in national and international journals.

Transcript.

1. What are the challenges you see in the Indian clinical trial sector today? Can you please mention how to overcome these challenges?

A:

- Quality of trial conduct.

- Gaps in Knowledge of Regulations, Ethics, and Science.

- Challenges can be tackled if all stakeholders participate passionately in the training and development of their teams and strive for quality in the conduct of clinical trials. Some of the actions are discussed below.

2. Despite professional competence and a large patient pool availability, India is yet to reach its potential in clinical trials. How this can be improved?

A:

- Professional competence is not in clinical research but in clinical diagnosis. We need investigators who are trained and passionate about academic clinical research, and who are willing to get trained in clinical trial regulations, ethics, and science, and who are willing to devote time to conduct good clinical research of internationally accepted standards. This is essential to build quality in clinical trials.

- Large patient pool is not organized or classified. The sites should develop a detailed database of patients, including demography, disease, and drug information. This would help in quick screening and fast recruitment of subjects.

- The government should create awareness about 1) the need for new drug development and clinical trials, and 2) regulatory efforts to ensure the protection of the rights, safety, and well-being of patients.

- Ethics committees should receive support, guidance, and training from government bodies – ICMR – and hospital administration to ensure that they can fulfill their primary responsibility of protecting the rights, safety, and well-being of patients.

- Industry sponsors should invest in supporting all the above efforts and encouraging academic investigator-initiated trials.

3. With the recent changes in new CT rules, what can be the benefits and shortcomings for clinical trials conducted in India?

A:

Benefits

- Time-bound approvals for clinical trials in 90 working days

- Advantages of Indian R&D discovery for the initiation of Phase I in 30 working days

- Accelerated approval/trial waivers for serious and rare diseases

Challenges:

- Investigators: Academic trials to comply with ICMR guidelines , Ethics committees (EC):

- Dual registration from the DCGI office and the Department of Health Research Composition: 50% non-affiliated members

- Short comings

- Independent Non-institutional ECs, which may not be competent in ethical oversight, are permitted to oversee clinical trials

- Sponsor is concerned about delays in approval because of irrelevant queries

- Lack of clarity/transparency in the regulatory inspection process

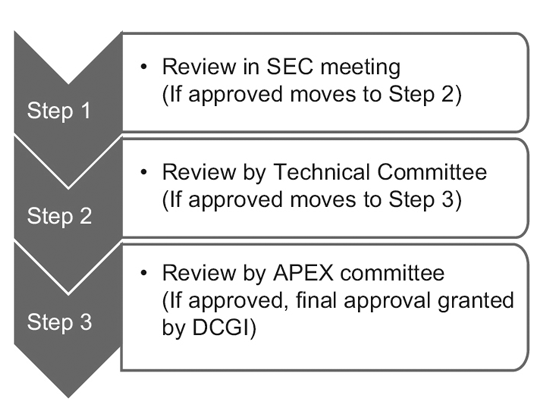

- No change/improvement in the SEC review process

- Approval requirements for non-interventional Phase IV studies

- Some of the criteria for accelerated approval/waivers are unclear and are at the discretion of regulatory authorities

4. What are the industry expectations from Indian regulatory going forward?

A:

- Transparency and clarity in accelerated/waiver criteria/pathways

- Professional regulatory inspection with graded regulatory actions along the lines of the FDA and EMA

5. Where do you see the Indian Clinical trials industry in the next 5 years?

A:

- Depends on how the new regulations improve the quality and conduct of Indian trials and how the society and media react to the favorable regulatory environment for new drugs and clinical trials

- All stakeholders should learn from past deviations and watchfully conduct clinical trials in compliance with regulations.

- Over the next 5 years, all stakeholders should strive for ensuring human protection and data integrity and to establish an image of India as a quality innovation R&D hub.

- Focus should be on quality, and Quantity will follow.

6. What are the current issues surrounding clinical trial data integrity, and what can be done to improve it?

A:

- Attitudinal shift by sponsors to reject data whose integrity is suspect

- Strengthen the QA and monitoring process

- Reward sponsor team members who discover data integrity issues and whistleblowers

- Action – suspension of the contract, blacklisting, regulatory notification, information sharing with industry – against responsible parties – in-house staff, CROs, investigator sites

- Training in documentation, monitoring, and QA for the sponsor and investigator site staff

- Training of ECs in oversight and monitoring to detect data integrity issues and to take appropriate actions

7. What measures should the industry take to ensure clinical trials are carried out safely?

A:

- Training of in-house staff – monitors, project managers, medical monitors, auditors, and site staff in pharmacovigilance, assessment of causality and clinical trial relationship of SAE, regulatory reporting, and compensation

- Train the site personnel thoroughly in protocol procedures, especially selection criteria, follow-ups, and safety assessments

- The project team should promptly detect important protocol deviations, which can impact the safety of subjects, and take appropriate actions, e.g., exclude patients, stop recruitment, and inform EC, etc.

- Medical monitor and the project team should verify the assessment of causality and clinical trial relationship of SAE by the investigator, considering company safety information and medical condition

- Ensure that the investigator complies with the regulatory requirements of free medical management

8. How do you position Indian ethics committees with respect to functioning and competence in the current global scenario? What are your views on the steps to be taken to further improve the functions of the ethics committee?

A:

- Barring a few empowered ECs in major academic institutions, most ECs lack competence in fulfilling their vital responsibility of ensuring the protection of rights, safety, and well-being of clinical trial participants.

- Department of Health Research should provide training and conduct ongoing monitor/review of the functioning of ECs.

On a closing remark, Dr. Arun Bhatt mentioned that “As a country, we should remember those who forget history are condemned to repeat it, and conduct clinical trials balancing the twin requirements of human protection and data integrity. We should comply with regulations and guidelines both in letter and spirit!”

Disclaimer:

The opinions expressed in this publication are those of the Interviewee and are not intended to malign any ethic group, club, organization, company, individual, or anyone or anything. Examples of analysis performed within this publication are only examples.

They should not be utilized in real-world analytic products as they are based only on the personal views of the Interviewee.

They do not purport to reflect the opinions or views of the VEEDA CRO or its management. Veeda CRO does not guarantee the accuracy or reliability of the information provided herein.